Debt Relief Programs and Options

There are many options when it comes to addressing your debt problems. Debtmerica believes it provides better Alternatives to Consumer Credit Counseling, Bankruptcy or Debt Consolidation Loans.

Below are summaries of the various alternatives available to you so that you can make an informed and well-educated decision based on your own individual situation.

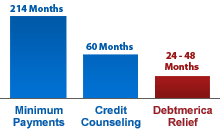

Assuming you are able to make all the monthly program payments, Debtmerica can offer Debt Resolution Programs that may help you resolve your debt in as little as 24-48 months without paying any fees until a successful resolution of a debt occurs. If you are experiencing a financial or personal hardship that is preventing you from paying your bills, the five most generally accepteddebt relief options you have are

- Bankruptcy.

While bankruptcy is a legitimate route to get out of debt, it can negatively affect your credit for as long as 10 years and can be a very unpleasant experience emotionally. You shouldn’t consider bankruptcy as a simple “quick fix” to all of your financial problems, but rather as one of the many available solutions you may have given your individual situation. As of October 2005, congressional legislation made filing for bankruptcy more difficult and burdensome. A Chapter 13 bankruptcy could result in higher monthly payments and may last longer than an alternative debt resolution program. If you have questions about bankruptcy or are considering it as an option, we advise you to speak directly to an experienced bankruptcy attorney licensed in your state. - Consumer Credit Counseling (CCC).

A Consumer credit counseling program is a method of debt relief for those who are unable to make minimum payments and undergoing financial difficulties. However, CCC programs could take up to 6 years or longer to complete and your debt is not reduced when compared to a debt resolution program. You may still have to pay back 100% of the debt you owe plus interest. In addition, if you miss just one monthly payment, you could be dropped from the program altogether.Consumer Credit Counseling Services, on average, have very high rates of client cancellation, which does not bode well for their delivery of a successful debt management program. (see below for more information on CCCs). With that being said, a CCC program may be a viable option for those with under $10,000 in unsecured debt, are able to afford higher monthly payment obligations, and are well disciplined to remain in the program. - Debt Consolidation Loan.

This option may work financially if you have at least an above average or good credit rating and considerable equity in your home. If you have a very large debt balance and have been late on just one monthly payment, it is likely that your credit may be impaired. Also, with this option, you do not reduce or settle your debt to a lower amount than the original balance; you are only transforming it from unsecured debt to secured debt. While a debt consolidation loan coupled with a debt resolution program provides a very powerful solution, remember that debt consolidation alone does not reduce or settle your debt; it only shifts your debt from one place to another. - Continue minimum monthly payments to credit card companies.

Many people struggle to make their minimum monthly payments and this option could take over 30 years to pay back the debt you owe, costs thousands of dollars in interest alone, and could require you to potentially pay back over three-times what you now owe on these balances. This may be the least timely, most costly, and most economically disadvantageous way to get out of your unsecured debt (see below for more information). Keeping high balances on your credit cards may affect your credit in a negative way and could make it more difficult to obtain any other type of loan. - THE DEBT RESOLUTION PROGRAM

Debt resolution is an aggressive method that allows the clients who make all their monthly program payments to settle their debt for less than the original balances owed in as little as 24-48 months. Debt resolution programs are custom-tailored to provide you with just one low monthly program payment. We feel this option could be one of the fastest ways for you to resolve your unsecured debt while we work hard to minimize your stress burden. Some programs offered by Debtmerica are performance based, which means we do not receive any fees until a settlement has been reached. However, if you are enrolled in one of Debtmerica, LLC’s attorney-based debt settlement programs, then Debtmerica, LLC may receive fees prior to any settlement being obtained with a creditor. Debtmerica offers programs that either charge fees as a percentage of savings or as a total percentage of enrolled debt balances. Regardless of which program you enter, you can expect the total fees of the program to range from 20% to 24% of the enrolled debt amount by the time you complete the program.If you are considering all of your debt relief options, and want to get out of debt, complete our easy and hassle-free 30 Second Savings Quote to see if a debt settlement program is the best option for you.

Debt Consolidation Loan

To be approved, you must have the ability to repay a larger home loan and also have an acceptable credit rating. Even if you do qualify, without debt settlement combined, your situation could likely get worse. Rather than helping you to reduce your debt through debt settlement, a consolidation loan may increase your debt burden. Here are some more facts that you may want to know about debt consolidation loans:

- You must qualify, which may be difficult given the recent mortgage reforms.

- It requires ownership of a home with considerable equity

- Closing costs are usually required upon closing or built into the interest rate

- Missing payments could cause you to lose your home

- You would pay back the entire balance of your credit cards, plus interest

- Payback could be 10-30 years or more depending on debt balance, type of loan, and your ability to pay

- You are paying off unsecured debts in favor of a new secured debt

- The debt consolidation loan reduces the equity available in your property for future use

Continue to Make the Minimum Payments or Don’t Pay Anything at All

- You could pay almost 50% of your original balance to your creditor in interest costs alone over the first 36 months. Your principal balance may barely be touched

- If your credit card interest rate is 25% or higher, it may be almost impossible to pay off your debt by making the minimum payments

- With a high credit card interest rate, it would most likely take you over 20 years to becomedebt free – and that’s if your balances don’t increase

- Until you pay off high balance debts, your ability to be extended credit becomes substantially more difficult.

If you have already stopped making payments to your credit cards or other creditors, you are negatively affecting your credit rating without reducing, settling or managing your debt successfully.

To see if you qualify for debt settlement, please fill out our 30 second savings quote form for a free, no cost or obligation consultation.

The projection assumes the following:

For example, if you owe $30,000 in credit card debt it may take you the following amount of time to resolve your debt

$30,000 in Credit Card Debt

Time in Years

Your actual results will vary depending on a variety of factors, including your current balances, how much you can afford to save per month, and the amount that your creditors are willing to settle for. We make no guarantee that your debts will be lowered by a specific amount of percentage or that you will be resolve debt within a specified time period.

About Debtmerica:

Debtmerica is a leading debt settlement company that offers assistance to individuals and families who are experiencing financial difficulties and hardship.

We offer debt resolution programs that specialize in negotiated debt settlement that assists clients by reducing debt balances while providing an affordable monthly payment.

Our professional and knowledgeable staff has helped thousands of consumers get back on their feet financially.